Independent wealth managers have the freedom to set their investment objectives, make their investment recommendations, and take the actions required to achieve those objectives. Once an investment objective is set, the manager can spend most of his time helping investors reach their desired level of retirement income. Independent wealth managers are permitted to provide independent financial advice. However, they are obligated to provide that advice only to individuals who meet their eligibility requirements.

There is no doubt that independent wealth management is a wise and sound idea for your future. The concept of Independent wealth management is about how you are going to plan for the future and what you want to accomplish in life. A lot of people get confused about whether they should go with an organization or not. Try to get information about Pillarwm as your wealth manager. They are professionals who will help you about how to manage wealth and assets.

What Is Independent Wealth Management?

“Independent wealth management” simply means the practice of building and managing one’s private wealth. This is generally done by investing money into real estate or any other investments that can yield a good return on the capital. For example, suppose you have a business with an estimated worth of ten million dollars. In that case, you can invest your savings to make up for the estimated loss of this sum if you fail to secure financing to purchase the business property.

Independent wealth management has many advantages over conventional methods of investing. First and foremost, one does not have to answer the boss or investors who are in it for profits or who may dictate the type of business to invest in. It is up to you to decide whether you want to do it through a mutual fund or a specific business investment scheme.

Second, as a small business owner, you do not have to deal with government regulations’ hassles. You have the freedom to invest in whatever type of investments that you want and according to your convenience. And third, because you invest on your own, you will know how much money to set aside for your business. In other words, it is your own money.

What is independent wealth management? Well, it is also known as self-directed investing. As previously stated, this method of investment does not involve the involvement of outside parties. Instead, you will be in charge of deciding what investments to invest in and how to invest it.

How does independent wealth management work? Well, you will need to decide on the type of business that you want to venture into. Then you must choose an appropriate location where you think you can start your business. Next, you have to figure out how to get your products or services into that location. This can be done by researching and checking out the market there.

The benefits of using independent wealth management

One of the most important benefits of using independent wealth management is that it can help you be more organized and financially well off. You should be able to make sure that your money is being managed properly.

There are several advantages of using wealth management. One benefit of using such services is that you will ensure that you have sufficient income to support your basic needs. Such services will also help to ensure that you are not overextended and could save yourself a lot of money in the long run.

It is a good idea to get professional help when you are looking to have some of your money in better hands. This could be beneficial for your financial future, which is a very good way to protect your assets. There are many different sorts of services that you can use to help with your finances.

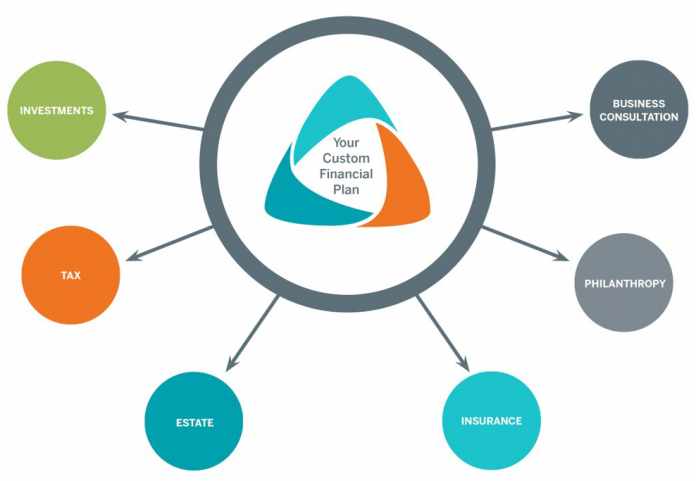

You can use one of the many different types of services that can help you with this process. Some of these services include estate planning, tax planning, and investing advice. These services should be used with a good deal of care, as this could potentially be dangerous for your money.

It is important to note that there are many different types of services available for use. You should take the time to check the different ones out and see what each one offers. You will need to find a service that suits your needs, and this is essential so that you do not end up paying for something that you do not require.

You will also need to consider the legal implications of using wealth management to your benefit. Some different laws govern how you should be able to handle your finances. When you are looking to take the best possible steps to ensure that you have the best possible chances of having your finances in the best hands, you should consider using wealth management. This is a very good way to ensure that you have a solid financial future. You will be able to work out a plan for your finances, and the best way to handle the money you have to not be putting too much of it at risk.

Do I need independent wealth management for my family?

Does it make sense to have separate financial accounts for each of your family members? It’s certainly better to keep one set of records for all of them, but you also have to worry about how you’re going to manage the money that you do have available. How can you afford to have just one set of accounts, even if it helps make certain transactions easier? A good rule of thumb is to keep a single financial account for each family member only, so you don’t end up with a bunch of different ones and have to juggle them all.

One of the best ways to do this is through a bank or savings account. When a bank account is used, you can use a separate bank account for each family member to manage their own money as they see fit.

The downside is that these accounts are often tied in with other accounts that your family uses. If you have a mortgage and you use your mortgage company to provide you with your account, then you may find that they won’t provide you with a separate account for the mortgage itself. You will find it difficult to open an account of your own, and you won’t be able to open a joint account with your children. You may find that this is going to be very limited.

However, this is not to say that there aren’t benefits in using individual accounts for your family. Many banks offer special credit cards designed to allow you to build up savings and even start a new business with your money. This can help create a more stable financial future for your family and even help with some of the financial planning that goes into your budget. It’s important, though, to keep in mind that even if you have an individual account, it’s still going to take up a lot of money.