When you’re in a tight spot financially, a payday loan can be a lifesaver. But before you apply for one, there are a few things you need to know. First, make sure you’re eligible for a payday loan. You’ll need to be employed and have a bank account. You’ll also need to be able to repay the loan on your next payday.

If you meet those requirements, you can apply for a payday loan online. Most lenders allow you to apply online and get a decision instantly.

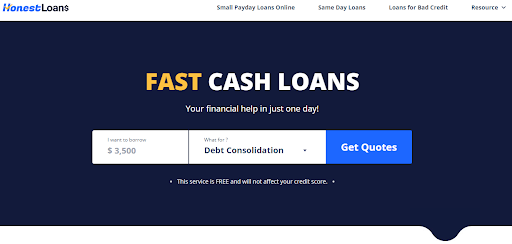

Once you’re approved, you can have the money deposited into your bank account as soon as the next business day. So if you need cash fast, a payday loan through HonestLoans is a great option. Just be sure to read the terms and conditions carefully before you apply.

Table of Contents

Popular Types Of Payday Loans Online

There are many different types of payday loans available online. It can be hard to know which one is right for you. Here is an overview of the most popular types of payday loans.

Direct payday loans are loans you get directly from a lender. These loans are unsecured, meaning you don’t need to put up any collateral. Direct payday loans are usually for smaller amounts, typically $1,000 or less.

Short-term loans are loans that are repaid over a shorter period of time, typically 2 to 4 weeks. Short-term loans are typically unsecured, meaning you don’t need to put up any collateral. Short-term loans are typically for smaller amounts, typically $1,000 or less.

Installment loans are loans that are repaid over a longer period of time, typically several months. Installment loans are typically secured, meaning you need to put up collateral. Installment loans are typically for larger amounts, typically $5,000 or more.

There are many other types of payday loans available online on sites like HonestLoans, including peer-to-peer loans, tribal loans, and even loans from friends and family. It can be hard to know which one is right for you. Do some research and compare the different options to find the best payday loan for you.

What’s The Criteria To Qualify For A Payday Loan Online?

There are many payday lenders available online, but not all of them are legitimate. So, how do you know which payday loan lenders are reputable and which ones to avoid?

The first thing to look for is accreditation from a credible organization. The Better Business Bureau (BBB) is one such organization that accredits payday lenders. So, if a payday lender is accredited by the BBB, that’s a good sign that it is reputable.

Another good indicator of a reputable payday lender is whether it is licensed in your state. State governments regulate payday lenders, so you can be sure that loans from licensed lenders are legitimate.

Finally, take a look at the company’s website. The website should be professional and easy to navigate. The company should also provide clear information about its products and services.

If you’re not sure whether a payday lender is reputable, do some research online. There are many websites that review payday lenders, so you can compare different lenders and find the one that’s best for you.

What Amount Can I Get With A Payday Loan Online

When you’re between paychecks and need cash quickly, an HonestLoans payday loan online can be a lifesaver. You can get a loan even if you have bad credit, and the process is simple and straightforward. However, it’s important to understand how payday loans work and what to expect before you apply.

A payday loan is a short-term loan that you can use to cover expenses until your next payday. The amount you can borrow depends on your income and your state’s laws. Generally, you can borrow between $100 and $1,000.

To apply for a payday loan online, you’ll need to provide some basic information, including your name, address, and Social Security number. You’ll also need to provide proof of income and employment. The lender will review your information and decide whether to approve your loan.

If your loan is approved, you’ll typically receive the money within 24 hours. You’ll then need to repay the loan on your next payday, usually in a single lump sum.

A payday loan can be a helpful tool if you need emergency cash, but it’s important to understand the costs and terms before you apply. Be sure to research different lenders to find the best deal. And if you can’t afford to repay the loan on time, be sure to ask the lender for a payment plan.

What Are The Rates For A Payday Loan Online

Are you in need of some quick cash? If so, you may be considering taking out a payday loan online. But before you do, you should be aware of the rates you’ll be charged.

Most payday loans charge a fee of around $15 for every $100 you borrow. So if you borrow $300, you’ll end up paying back $345. And if you can’t repay the loan on time, you’ll usually have to pay a penalty fee as well.

So is a payday loan a good option for you? That depends on your individual circumstances. But if you need to borrow money quickly and you can afford to pay it back in full and on time, then a payday loan may be a good option for you.