There is not much awareness in India, with regards to life insurances. People still don’t give due importance to life insurances let alone understanding it. While many people have not even thought about getting one, it is a delight that you have taken your first step today securing the future of your family and loved ones if something happens to you.

While talking about buying a life insurance policy, you will find yourself puzzled. Mostly it is because, every policy sounds the same, and you are not able to make out what is right for you. And you might delay the task for future and time never comes.

So, “India is an under-penetrated market” as per the experts. And that is true. Facts show our life insurance market penetration is just about 2.76% which is indeed very low.

So, why do you need to get life insurance?

Firstly, if you are a sole breadwinner for the family, it is something you must have undoubtedly. There are many families today that are suffering because the sole breadwinner in the house died. Imagine the difficulties of the family.

Moreover, it is not just about getting a life insurance plan, rather it is about getting the right one. You should be well aware of evaluating the insurance policies, what riders to choose, what plan to buy and what company to buy from. So, let’s get started.

Types of Life Insurances

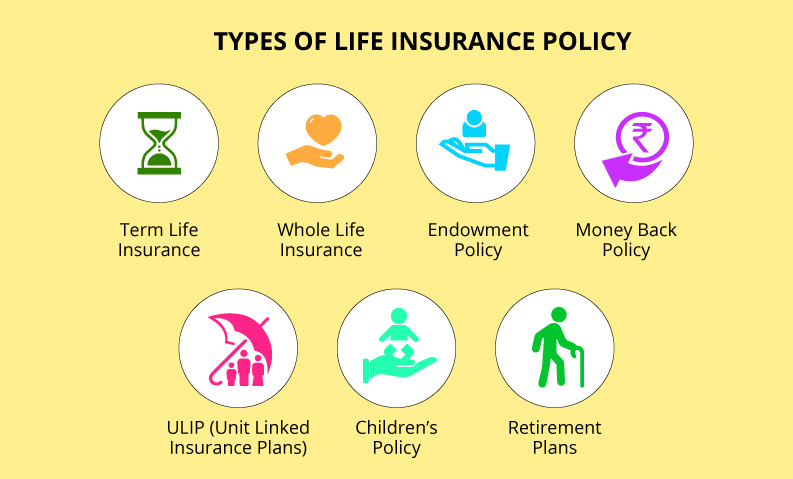

There are different types of products available in the market, the simpler it is, the better it is. Mostly, we humans are more attracted to complex things, psychologically we pay extra for stuff that looks bulked with various terms and conditions. And thus, insurance companies use that as much as possible to provide u withs insurance plans such as:

1. Term Life Insurances

It is the simplest life insurance; you are required to pay a premium to cover your life risk for a specified period. Something happens to you during the term, the family gets the sum assured. If you survive the term, the policy matures and you are not paid anything. It is very affordable and simple.

2. Whole Life Plan

You pay a premium for a defined period and are covered until 100 years of age. Nobody thinks they will be able to live 100 years if you outlive the term but you will get the maturity benefits.

But the catch is they aren’t cheap as term insurance and can cost you some money. The risk is higher for the insurance company, as they have to pay 99.9% of the assured sum.

3. Endowment Plan

Now, you will notice that we are slowing moving towards more complex plans. With the endowment plan, you get a life cover and a large part of your investment brings a return to you in the term maturity benefits and bonuses.

The money is payable when one dies or at the maturity or both. The returns are not high, but low since the investment made by the insurance company is in safe financial instruments.

You have to pay a premium for a fixed period and get a corpus at the end of a particular period. Particularly the return on investment is not more than 5-6%, which is very low as compared to what you pay.

4. ULIP

ULIP or Unit Linked Insurance Plans are subject to market risk. The insurance company invests in the equity market, and thus the returns are much higher than what you get in endowment, but also the risk is high.

Also, the fee is higher which includes admin charges, investment charges, unit switching charges, etc. Also, notably ULIP plans are not great when compared to mutual funds.

5. Children Plans

They are sold under the pretext of insurance, just like in other investment types such as ULIP, you can earn a major tax benefit by taking a child plan.

These plans are tied to the long-term financial goal of your child, they are good for education or marriage and you can plan a return period accordingly. The money is invested in equity and hence doesn’t guarantees the fixed returns. It is like buying a ULIP but with a different plan.

6. Retirement Plans

Similar to the children plan the goal is to build a decent corpus for your retirement. You get a small amount of life insurance while a major part of the investment is still market-linked securities.

Conclusion

Now that you know what are the different types of insurance plans available in the market today, you will easily be able to align their benefits and pitfalls as per your needs and financial goals. If you have any questions or concerns, consider reaching out to a life insurance attorney.

Choose wisely, read the terms and conditions of the plan very well to make an informed choice.