Buying a house is one of those points all people have in their to-do lists. However, buying a home is not as easy as writing it down in your wish list. It is a complicated and stressful process that requires a lot of money and planning. However, there is no other feeling more satisfying than Buying your First Home. Therefore, this guide takes you through a step by step process to buy your own home.

Table of Contents

Start Saving Your Money

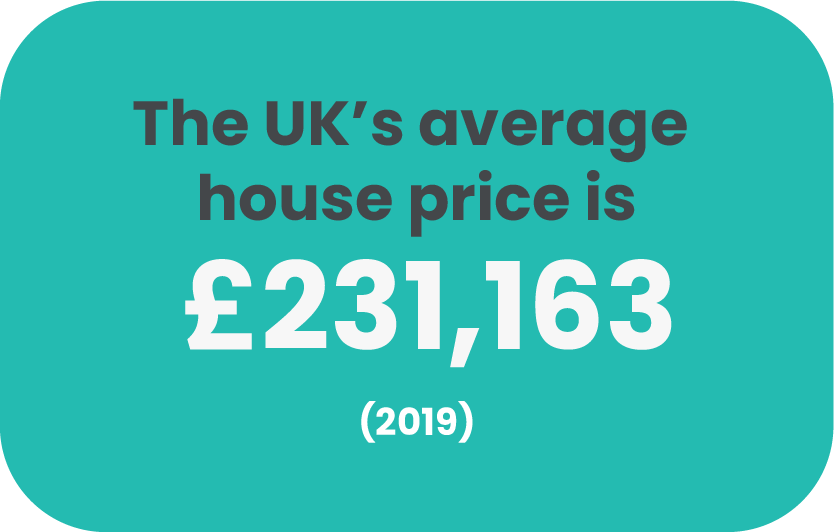

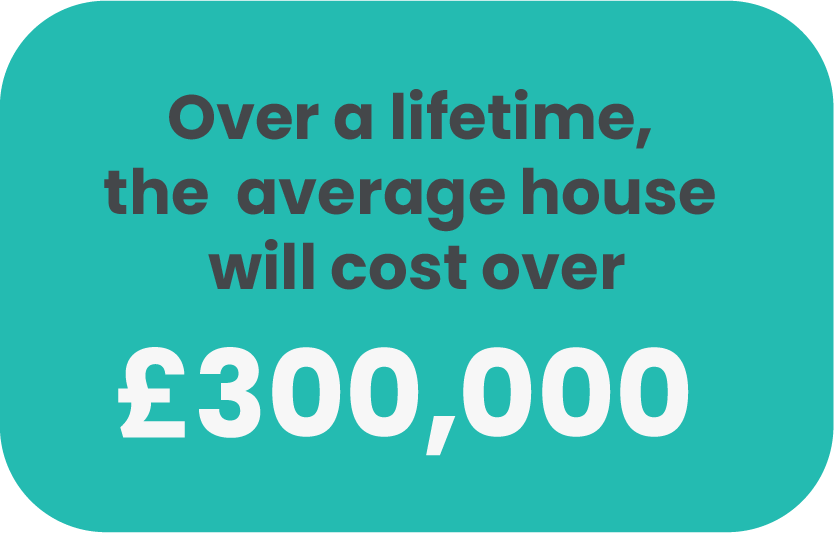

Money is the most essential asset you need if you want to buy a house. The more money you have, the better the home you can purchase. Therefore, start putting aside money for deposit in a savings account. Moreover, look for a savings account with reasonable interest rates, so that you can get some additional money for buying your house.

Set Your Budget

Before starting your hunt for properties, work out on your budget. There is no point of browsing £500,000 properties if your budget is £300,000. Doing so will not only waste your time but also bring in disappointment and dissatisfaction. Therefore, consider all the possible cost and create a budget accordingly. Other than the price of the property, additional expenses that arise during a property purchase are:

- Solicitors

- Land registry fees

- Surveys

- Mortgage fees

- Stamp duty

- Removals

Consider these costs to figure out the total cost of buying a house. Although these costs can vary depending upon the price and type of property, you should keep aside £5,000 to £7,000 to cover these expenses.

Stamp Duty

If you want to purchase a house in England, Wales, or Northern Island, you don’t need to pay stamp duty for a home that costs up to £125,000. If the property costs more than £125,000, the following rates will apply.

- 2% for properties between £125,001 and £250,000

- 5% for properties between £250,001 to £925,000

- 10% for properties between £925,001 to £1.5 million

- 12% for properties above £1.5 million

Find a Suitable Mortgage Deal

Before you start looking for properties, it is a better move to find a good mortgage deal that suits you. After signing the agreement, the moneylender will take you through the application process to work out regarding the amount you can borrow. Although you don’t need to borrow the money instantly, you can get an idea about the amount of money you can borrow when you need.

Start Hunting for an Ideal Property

Once you have fixed your budget and signed a mortgage deal, it’s time to start looking for properties. If you are moving to a new area, it is crucial to get a feel of the local market. Therefore, speak to the real estate agents and locals about the area. A couple of things to consider before finalising a property are:

- Details about the desired neighbourhood

- What represents a bargain and what will you get for your money

Pondering over these points will help you figure out the area you that suits you depending upon your budget and neighbourhood needs. After finalising the area, a few things you need to do are:

- Browse through websites and local newspapers regularly

- Get in touch with numerous agents, and ask them to keep you updated with the latest properties.

- Start checking out various properties, even if they are not your type. The more houses you see, the better idea you get about what you should expect from your money.

After you checkout, multiple properties, compare them on the following points.

- Properties’ strength and weaknesses, and what excites you and what not

- Features of your interest like the size of the garden, number of rooms, etc.

- Have an open mind. Don’t limit your choices and try looking for different types of houses.

View Properties like a Pro

Before arranging a property visit, have a look at the Home Information Pack (HIP). It is the responsibility of the agent and the seller to provide the HIP. With the help of a HIP, you can get a decent idea of the property even without visiting it. When looking at the HIP, consider the following points. If you like the property from the HIP, arrange your first visit. A few things to consider on your first visit are:

- What features are included in the price

- Look at the layout: the size of rooms, size of the kitchen, etc.

- Check out the type of ceiling and window frames

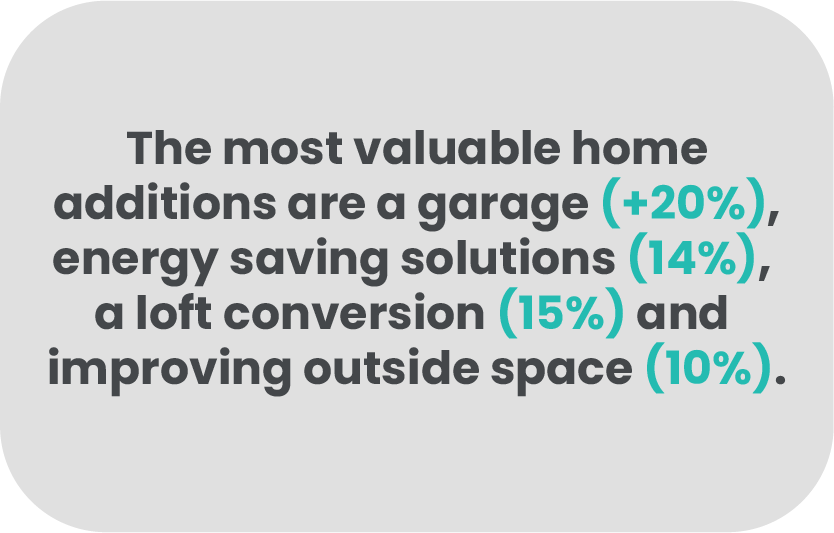

- Check the insulation, ventilation, and plumbing, garage

Your first visit should be intended to rule out properties that are not ideal. After ruling out unwanted properties, arrange a second visit to the selected properties. Your second visit is indented to finalise a property and make an offer. On a second visit, you should:

- Check out the property at different times during the day

- Take a relative/friend for opinions

- Arrange more meetings if necessary

Hire a Surveyor

Just because you loved the property, that does not mean that the property is perfect and ideal to buy. Before making an offer and finalising the deal, call a surveyor to examine the property and create a survey report. Read the survey report properly to figure out about the unseen issues and costs.

Make Your Offer

If you have visited the property multiple times, and you are satisfied by the location, design, features, and fixtures of the property, you should start negotiating. A few tips to keep in mind while making your offer are:

- Always offer less than the asked price. All real estate properties have a scope for negotiation, and no property sellers expect the demanded price.

- Consider the age of the property, its condition, and the repairs needed while making an offer.

- Update your real estate agent with your offer and the issues, if any, in the property

- In most cases, the realtor will get back to you with the seller’s response unless your offer is too bad.

- If the owner does not agree to your proposal, think about whether you want to purchase the house on a higher price or look for other properties

- If the seller accepts your offer, ask him to take the property down from sale immediately.

Hire a Solicitor

It is not a choice, but a necessity to appoint a solicitor to look after the legal side of the process. Some real estate brokers might ask you to let them appoint a solicitor on their own, but you should not let that happen. Hire a good solicitor that will view the HIP of the property, and help you with ensuring that everything is fine, and there are no issues in the deal.

The solicitor will also help you with the contract negotiation and carry out the completion of the transfer of funds and title deeds. You will then finalise a date of completion and will have to give a pre-agreed deposit to the seller.

Completion

This is the day you have been waiting for. Your seller will vacate the property, and you will transfer the required funds to your seller. Your solicitor will take care of the fund transfer and other legal proceedings. You will get your hands on the key of the property and will be the official owner of the house.