Oil, often referred to as “black gold,” has been a coveted commodity since the dawn of the industrial age. Traditionally, the oil trading sector relied on human intuition, long-standing relationships, and basic statistical models. However, in recent years, there’s been a seismic shift towards data-driven methodologies, reshaping the landscape of oil trading. Encounter one of the industry’s top platforms visit Oil Profit website now.

Table of Contents

The Power of Advanced Analytics in Trading

Advanced analytics involves the use of modern data processing techniques to derive actionable insights. In the oil trading industry, these analytics enable traders to make informed decisions based on vast and varied data sources. More than just number-crunching, advanced analytics offers predictive insights, helping traders anticipate market shifts.

Key Drivers for the Adoption of Advanced Analytics in Oil Trading

Several factors have prompted the oil trading industry to embrace advanced analytics:

- Volatility in Oil Prices: The frequent and sometimes unpredictable fluctuations in oil prices necessitate tools that can offer foresight. Advanced analytics provides this foresight, equipping traders to navigate volatility.

- Optimized Supply Chain Management: With the complexity of the oil supply chain, there’s a pressing need for optimization at every stage. Analytics aids in streamlining operations, ensuring timely deliveries, and minimizing wastage.

- Rising Operational Costs: As operational expenses soar, companies are in dire need of efficiency. Advanced analytics identifies areas of cost leakage, offering solutions to mitigate them.

- Global Economic Shifts: The global landscape is ever-evolving, with politics, environmental concerns, and economic policies playing pivotal roles. Advanced analytics helps traders stay ahead of these shifts.

Advanced Analytical Tools & Techniques in Oil Trading

The tools and techniques underpinning advanced analytics in oil trading are multifaceted:

- Machine Learning Models for Predicting Oil Prices: By analyzing historical data, machine learning algorithms can make surprisingly accurate predictions about future oil prices.

- Time Series Forecasting: This technique is crucial for predicting future values based on previously observed values, especially pertinent for oil price predictions.

- Neural Networks and Deep Learning: These are subsets of machine learning but with a focus on large data sets and algorithms inspired by the structure and function of the brain. They’re particularly effective for pattern recognition.

- Natural Language Processing (NLP) for News Sentiment Analysis: NLP algorithms sift through global news, extracting sentiments that could influence oil prices.

Integrating Real-time Data Sources

Real-time data is the lifeblood of advanced analytics:

- IoT in Oil Industry: Internet of Things (IoT) devices, from sensors on oil rigs to trackers on tankers, provide a constant stream of real-time data, offering instantaneous insights.

- Satellite Imagery: With satellites, companies can track global oil tankers or even detect changes in storage facilities, providing a clearer picture of supply dynamics.

Challenges & Limitations of Advanced Analytics in Oil Trading

Despite its immense potential, advanced analytics isn’t without challenges:

- Data Quality Concerns: The insights derived are only as good as the data fed. Inaccurate or outdated data can lead to misguided strategies.

- Over-reliance on Models: While algorithms provide clarity, over-dependence on them without human oversight can be risky.

- Regulatory and Ethical Considerations: As with any powerful tool, there’s potential misuse. Ensuring ethical use of data and respecting privacy regulations is paramount.

- Talent Gap: The industry needs professionals adept at both oil trading and data science. Bridging this talent gap is a pressing challenge.

Case Studies: Success Stories & Lessons Learned

Leading oil companies like Shell and ExxonMobil have adopted analytics to great success. For instance, by integrating real-time data analytics, Shell optimized its supply chain, resulting in cost savings of millions annually. On the flip side, early adopters also faced challenges, such as data silos and resistance to change, offering lessons for newcomers.

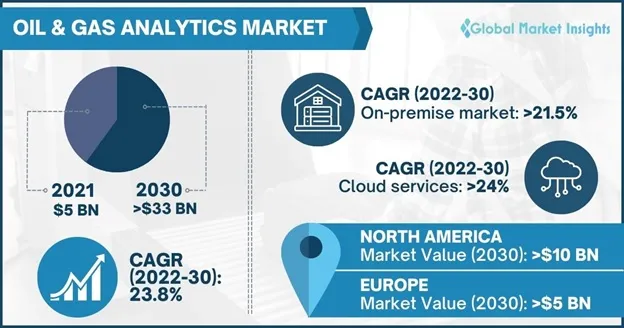

The Future of Advanced Analytics in Oil Trading

Looking ahead, the nexus of advanced analytics and oil trading is set to become even more intertwined:

Quantum Computing: With its ability to process vast amounts of data simultaneously, quantum computing could revolutionize analytics in oil trading.

Sustainability and Green Energy: As the world shifts towards renewable energy, analytics will play a role in optimizing the green energy supply chain and integrating it with traditional oil networks.

- Blockchain in Oil Trading: This technology promises transparent and tamper-proof transaction records, further enhancing the efficiency and reliability of trades.

Conclusion: Embracing the Data-Driven Future

The fusion of advanced analytics and oil trading isn’t just a fleeting trend; it’s the cornerstone of the industry’s future. As the landscape evolves, entities where traders can seamlessly buy and sell oil, are emerging to meet the demands of this interconnected world. The oil trading sector stands to gain immensely, promising not just refined returns but a brighter, more sustainable future.