As an oil trader, you are always on the lookout for new and effective trading strategies. One of the most powerful indicators you can use is the Average Directional Index (ADX). In this article, we will explain what the ADX is and how to use it to trade oil successfully. When it’s time to enter the crypto market, selecting a reliable exchange like Bit-QT is crucial for seamless buying and selling of cryptocurrencies.

What is the ADX?

The Average Directional Index, commonly known as ADX, is a technical analysis tool that traders use to evaluate the strength of a trend. It was developed by J. Welles Wilder in the 1970s, and since then, it has become a popular tool among traders.

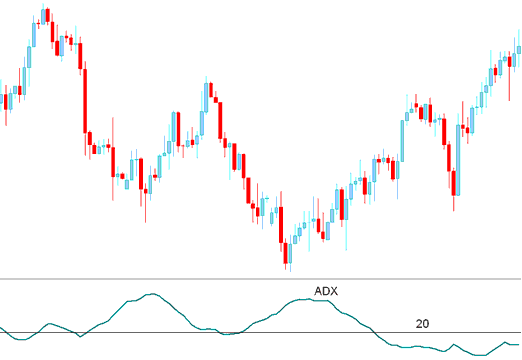

The ADX consists of three lines: the ADX line, the +DI (positive directional indicator) line, and the -DI (negative directional indicator) line. These lines work together to provide traders with valuable insights into market trends.

The ADX line is the primary line and measures the strength of the trend. A high ADX reading indicates a strong trend, while a low reading indicates a weak trend. The ADX line is plotted as a black line on the chart.

The +DI line and the -DI line measure the direction of the trend. The +DI line represents the bullish trend, while the -DI line represents the bearish trend. When the +DI line is above the -DI line, it indicates a bullish trend, and when the -DI line is above the +DI line, it indicates a bearish trend. These lines are plotted as green and red lines, respectively.

Traders can use the ADX to make trading decisions by looking for crossovers between the +DI and -DI lines or by monitoring the ADX line’s level. When the ADX line is above 25, it indicates a strong trend, and traders may look for opportunities to enter or stay in a trade. Conversely, when the ADX line is below 25, it indicates a weak trend, and traders may look for opportunities to exit or avoid a trade.

Table of Contents

How to Use the ADX to Trade Oil

The ADX is a versatile indicator that can be used in a variety of ways to trade oil. Here are some of the most effective ways to use the ADX:

Identify Trending Markets: The ADX is primarily used to identify whether a market is trending or not. If the ADX line is above 25, it indicates that the market is trending, while a reading below 25 indicates that the market is ranging. In the case of oil trading, if the ADX line is above 25, it could be an indication that the market is trending, and you should look for opportunities to enter trades in the direction of the trend.

Confirm Trends: The ADX can also be used to confirm trends identified by other indicators. For example, if you are using a moving average to identify trends in the oil market, you can use the ADX to confirm the strength of the trend. If the ADX line is above 25 and the moving average is sloping in the direction of the trend, it could be a strong indication that the trend is likely to continue.

Manage Risk: The ADX can also be used to manage risk in oil trading. If the ADX line is above 25 and you are in a long trade, you may want to place a stop loss below the recent low to protect your position. Similarly, if you are in a short trade, you may want to place a stop loss above the recent high to limit your risk.

Identify Reversals: The ADX can also be used to identify potential market reversals. If the ADX line is above 25 and begins to decline, it could be a sign that the trend is losing strength and that a reversal is imminent. In this case, you may want to consider closing your position or placing a stop loss to protect your profits.

Conclusion

The ADX is a powerful tool that can help oil traders identify trends, confirm trades, manage risk, and identify potential reversals. By using the ADX in conjunction with other technical analysis tools, you can develop a robust trading strategy that can help you succeed in the highly competitive oil trading market.