Thousands of employees from various countries make up the workforce, and companies trade oil in over-the-counter markets. Platforms have a robust algorithm that performs the research for bitcoin traders and makes trading easy. Also, it has helped many beginners to get started with bitcoin trading. Oil miners and cryptocurrency miners have some similarities: both produce low-value products in high volume; both mines for a decentralized network using specialized equipment; and global supply chains are complex to manage for both companies. If you are investing in Bitcoin, you must know what occurs to bitcoin after a bitcoin holder expires

However, there are also significant differences between these two industries: oil mining does not require expensive equipment, and humans work together on sites with multiple sectors, including power generation, gas processing, refining, transportation, etc. The catalysts for a price decline in oil are the same as the catalysts for a crypto price decline: technology, regulation, and supply and demand.

In addition to the potential threats posed by technological disruption, a much-discussed topic in both industries is “too big to fail” (TBTF) – humans often do not have enough insight into the dynamics of their drive for them to make informed decisions about what course of action is best. This post is an example where both market participants can find common ground.

Challenges in oil mining:

Some of these companies have also been massively successful: ExxonMobil’s market value is over $350B, while Shell’s market value is over $230B. To ensure the ongoing success of these large consumer-facing corporations, many firms have responded by trying to procure smaller oil and gas projects to make more efficient use of their capital investments.

It highlights how important feedback loops are between supply chains between oil and gas industry participants – they cannot be ignored when considering industry structure as it relates to supply chain management.

Firstly, the link between upstream and downstream participants has to be there: firms often have to exercise a great deal of creativity to procure the exemplary service or product at the right time and in the correct quantity. Moreover, it can be tricky since many providers only offer generalized products that people cannot optimize to fit a particular firm’s needs.

Secondly, firms need help differentiating between competitors who provide similar products or services. In this way, their suppliers’ strategies tend to influence their strategy. Thirdly, it is also tricky for firms to manage relationships with upstream and downstream participants because of the number of links involved in contracts between them.

Challenges in cryptocurrency mining:

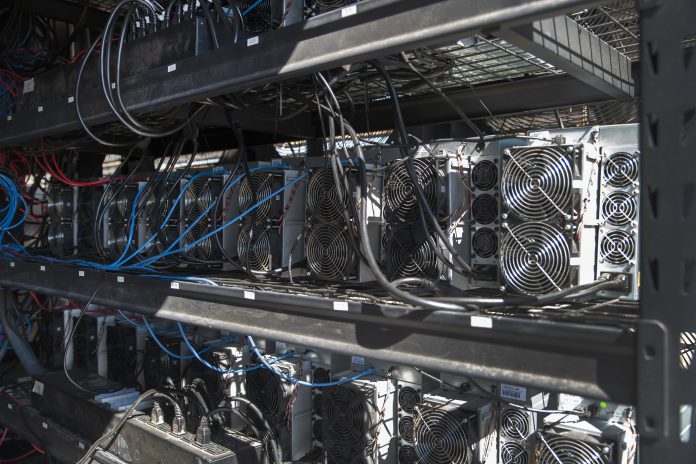

Cryptocurrency mining is also a complex industry. It involves many participants: miners, developers, users, investors, and speculators. They have different and often conflicting interests in cryptocurrencies based on distributed ledger technology (DLT). Although DLTs enable transparency and security concerning contracts, they can also provide opportunities for confidential business information to be leaked or manipulated by malicious third parties. Disputes between market participants are common in both industries because of the many parties involved who may have conflicting interests.

Similarities between cryptocurrency mining and oil mining:

Cryptocurrency and oil mining are posed to technological disruption:

Companies have proposed mechanization and automation to tackle the challenges posed by technological disruption for both industries. The rise of ‘intelligent machines’ is expected to remove many human workers from the workforce, thereby reducing costs and the amount of waste energy consumed.

At the same time, these machines are often expected to consume more energy than they produce – in this way, they become a source of environmental pollution. For example, advances in robotics will pose a significant threat to oil and gas workers if not properly managed. In addition, advances in AI technology may also threaten oil industry jobs and increase capital investment needed for oil extraction. These potential problems have led to widespread concern regarding ‘the fourth industrial revolution and its consequences on society.

Oil and cryptocurrencies are mined by people using specialized machines:

Both cryptocurrency and oil are extracted by oil miners using specialized machines. Miners create bitcoin with powerful computers that use an energy-intensive computing process. Oil is mined from the ground but requires more than three times as much energy as bitcoin. To put this into perspective, the amount of energy needed to mine bitcoin per day could power over 5,700 homes in the U.S. It contrasts with the 9,450 homes powered by the oil required to produce six barrels of crude oil every day.

External factors cause disruptions in both industries:

Cyberattacks in both the cryptocurrency and oil industries are a result of the relationships that exist between the firms. Cyberattacks in oil typically occur within companies and include theft, fraud, and misuse of information. Cyberattacks on cryptocurrencies typically happen between companies and include pump-and-dump schemes, Ponzi schemes, and hacks. In addition, both oil and cryptocurrencies are subject to supply & demand factors as well as regulatory intervention: Cryptocurrencies are subject to demand factors such as unconfirmed transactions, slow transactions due to limited block sizes, hacker attacks that can drain wallets, etc. – this is one of the primary reasons why miners can’t always predict how much they will earn in a month.