Buying a new home can seem like both an exciting and daunting process. No transaction is ever the same, whether you are a first-time buyer or a proficient property investor, there are often new obstacles to tackle during the conveyancing process.

There are very few purchases we will make in our lifetime that are bigger and of a larger commitment than property. Therefore, it is essential to be one hundred percent certain the right choice is being made. See this guide for more information.

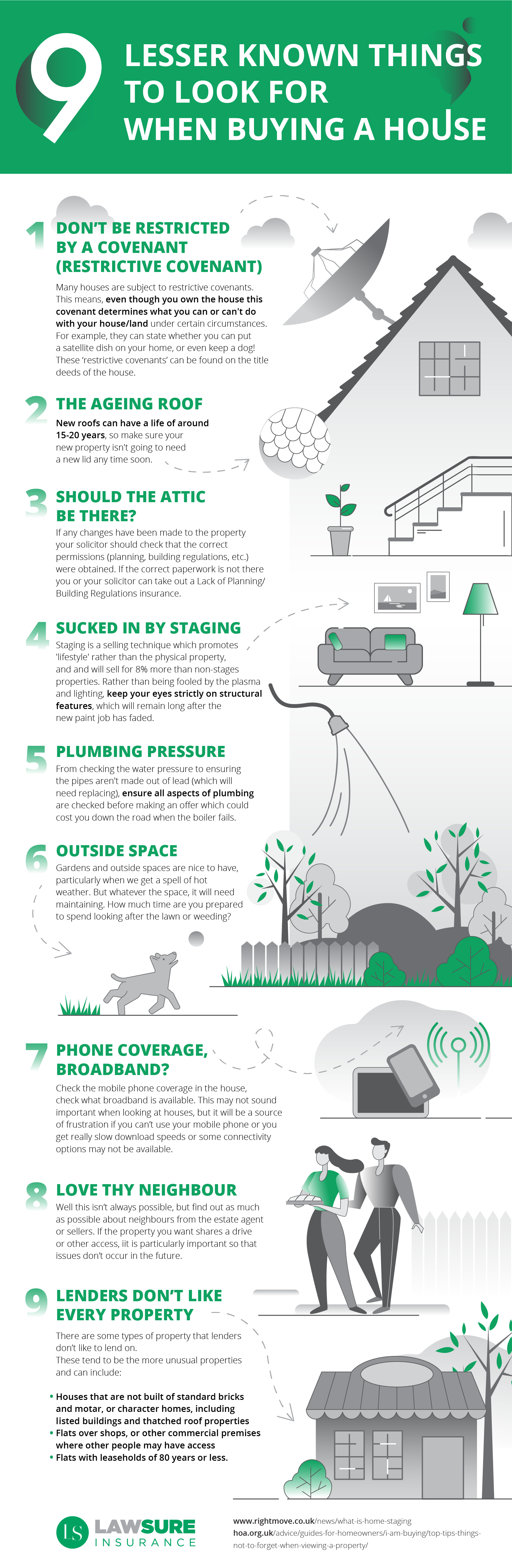

The team at Lawsure have put together useful information in relation to lesser-known things to look out for when buying a new home to help us avoid any nasty surprises and costs later on.

Table of Contents

1. Restrictive Covenants

Restrictive covenants are rules and regulations set out for the particular property and not the individual owner. For example, this could be restricting you from running a business from the property or even hanging out your washing (source).

These restrictions can be found on the Title Deeds, although they may not always be worded in the clearest of ways. Your solicitor should pick these up and alert you to them early in the process.

Unfortunately, some people defy these restrictions and are often hit with hefty penalties and lawsuits.

If you wish these covenants to be removed and have just reason to do so, you can apply with The Land Registry or The Land Tribunals to have these removed. However, these applications can take up to two years and can also be rejected so don’t rely on it!

2. Roofing

Unfortunately, it is unlikely you will be able to easily look at the roof yourself when viewing properties. New roofs have an average lifespan of 15-20 years.

Speak with the vendor to ask when it was last replaced and if anything is still under guarantee. If not, consider doing extensive research into different building insurance policies as some may offer better cover than others.

When choosing your surveyor, make sure they can provide a full report on the roof as well.

Ultimately, this can save you costs in the long term.

3. Planning Permission

It isn’t obvious if building works have been carried out correctly. Even if they have been done to the highest standard, it doesn’t mean the correct paths have been following.

Planning permission and building regulation compliance certificates should be passed onto the buyer upon completion. Your conveyancer should establish if these are available beforehand and obtain undertakings from the vendor’s solicitor that these will be passed on.

If these are not available from the vendor, then insurance can be taken out to protect yourself. Often the cost will be covered by the vendor in the form of an allowance but be prepared to pay this yourself if they are being difficult.

Insurance is required, as even though you may have not been the person to do the work in the house, the current owner is liable for any repercussions if planning permission was not obtained.

4. Staging

Staging is a technique used in properties to advertise lifestyle rather than the property structure itself.

Try to not be blinded by flowers, fancy furniture and expensive technology. Considering these won’t be there where you move in, focus on the building itself.

Although not legally required, structural surveys are highly recommended to gain a professional opinion. Some mortgage lenders request this as mandatory before they will release your mortgage advance.

When your survey is received, be sure to read it carefully and note any issues you would like to raise. When in doubt, speak to your solicitor. The earlier this is completed the better as this can give time to work any changes into the contract.

5. Plumbing:

Plumbing is something we all use on a constant daily basis and is something most of us would struggle to live without.

Ensuring pipes are in good working order is essential. When viewing properties, check the shower pressure, estate agents are used to this request but won’t always offer it.

Structural surveys are just that, the ‘bricks and mortar’. Many companies do offer a more extensive survey which can include the plumbing and the boiler.

Although the vendor may state these are in good working order, you can not always take their word as gospel.

Also Read: Things To Consider Before You Buy A Property With A Teardown House

6. Gardens

When placing an offer on a beautifully landscaped garden, consider if you can maintain it. The current owner may spend a large amount of time and money keeping it in this condition.

If you are unable to commit to such a task, are you able to have this changed to something that requires less maintenance?

Neglecting gardens can make them an eyesore, unusable and often more costly to rectify.

Overgrowing plants that encroach on neighbouring gardens can be a cause for arguments and bitter relations.

So, before you fall in love with an extravagant green space, make sure you can manage it.

7. Connectivity

Check who the current broadband provider is, if you are not happy to choose them check with your preferred provider that they can cover the area.

You can also ask most providers to provide their speeds for the location, if they are unable to cater to what you need this could cause issues when you have moved in. See usave broadband deals here.

When viewing the property, use your mobile phone to make calls and texts. It could become incredibly frustrating if you find coverage is insufficient in your own home.

8. Neighbours

Your new home could be everything you ever wished for, but unruly neighbours can often disrupt your new bliss.

When viewing properties, don’t rely on estate agents and vendors to be honest about the neighbourhood. Afterall, their main goal is to make a sale.

Do your research on the area and don’t feel afraid to speak to current residents, they are far more likely to give an honest opinion.

Checking if bordering properties are rented can also help. There may currently be a lovely older couple living next door, but this could change. No one wants to live next to students who are partying frequently until the early hours.

9. Mortgages

Mortgage lenders can often have a longer list of requirements than you do when it comes to property.

Lenders are only willing to invest their money if they know that investment is safe. Your property may seem like a certain investment to you, but they may think differently.

Using a broker to help find your mortgage will benefit as they have a better understanding of what could be an issue.

If buying a flat with a leasehold of less than 80 years, consider tying a lease extension into the contract. Not only could this satisfy your lender, it will also make your property more marketable in the future.