Disclaimer: This post is sponsored by PSECU, a Pennsylvania-based credit union.

If you’re looking to buy a home for the first time, you may have many questions about obtaining and keeping a mortgage. Even if you’re a seasoned property investor, keeping up with the changing market proves challenging.

What should you know before taking out a new mortgage? First, you must evaluate what options are available to you. Then, determine which works best for your unique financial profile as well as your future plans. Here are six things to know before signing and initialing multiple times on the dotted line.

Table of Contents

1. Different Types of Mortgages Exist

Not all mortgage products are created alike. This enables lenders to open the doors of homeownership to buyers who may not qualify otherwise. However, the array of products does cause confusion, and consumers should know what to look for.

- Fixed rate vs. adjustable rate: In a fixed-rate mortgage, you make essentially the same payment each month. Your rates remain stable, at least until you refinance. Monthly payments vary with adjustable-rate mortgages, as these use the market index to determine interest rates. Some months you pay more, while other months you pay less.

- Prime vs. subprime: Prime mortgages go to buyers with the best credit histories. Subprime mortgages fell out of vogue after the 2008 market crash, but have made a comeback in recent years. These charge higher interest rates but enable buyers with less-than-perfect credit to buy homes.

- Commercial vs. government-insured: Commercial mortgages may charge more favorable rates but require higher down payment amounts. Government-backed mortgages like FHA and USDA loans require less money down, but property and lending limits apply.

2. You Can Find Down Payment Assistance

Several federal programs help buyers qualify for a home with little to no money down. Depending upon where you live, your state may offer down payment assistance grants, and certain lenders offer savings match programs when you save toward a home.

If you teach or work in public service, you may qualify for down payment assistance to buy homes in certain neighborhoods as part of revitalization efforts. The Veteran’s Administration offers no-money-down mortgages for current and former service members.

3. Conforming or Nonconforming?

Rarely does your mortgage remain with the original lender. They often sell conforming loans to Freddie Mac or Fannie Mae, government-backed agencies that set specific guidelines for which mortgages they accept. Nonconforming mortgages refer to loans not meeting the guidelines for Freddie Mac or Fannie Mae.

Buyers use nonconforming loans to purchase large properties not falling within certain price limits — this is referred to as a jumbo mortgage. Because investors back these loans, buyers need excellent credit scores and substantial down payment amounts.

4. Your Credit Determines Your Rates

If you’re looking to buy, pay down as much debt as you can and pass on taking out any new credit lines. Not only could doing so lose you mortgage approval if it pushes your debt-to-income ratio too high, but it could also mean paying much more over the life of your loan.

However, don’t give up hope if buying home furnishings on a credit card bumped up your interest rates. You can buy, and once you’ve paid down debt and raised your credit score, you can refinance your mortgage to get a more favorable rate.

5. Watch Your Debt-to-Income Ratio

Another factor influencing your interest rate is your debt-to-income ratio. The less other debt you have in addition to your mortgage, the lower your rates. If you have student loans, for example, you can still win approval if you apply for deferment or forbearance in some cases. However, you will pay more interest.

Even a small percentage shift makes a big difference over the life of your loan. For example, a change of only 1 percent on a 30-year fixed mortgage of $160,000 results in paying nearly $30,000 more total.

6. You May Need Private Mortgage Insurance

If you have less than 20 percent of the purchase price, you will need to pay private mortgage insurance (PMI). This protects the lender somewhat in the case you default, but it results in a higher monthly payment. However, with most lenders, once you hit 20 percent of the purchase price, you can apply to remove PMI. Likewise, if you pay for half the allotted payoff time — 15 years on a 30-year mortgage — you qualify to stop paying PMI in many cases.

Choosing the Right Mortgage for You

Now that you know more about the types of mortgages available and the advantages and disadvantages of each, you’re able to make a more informed buying choice.

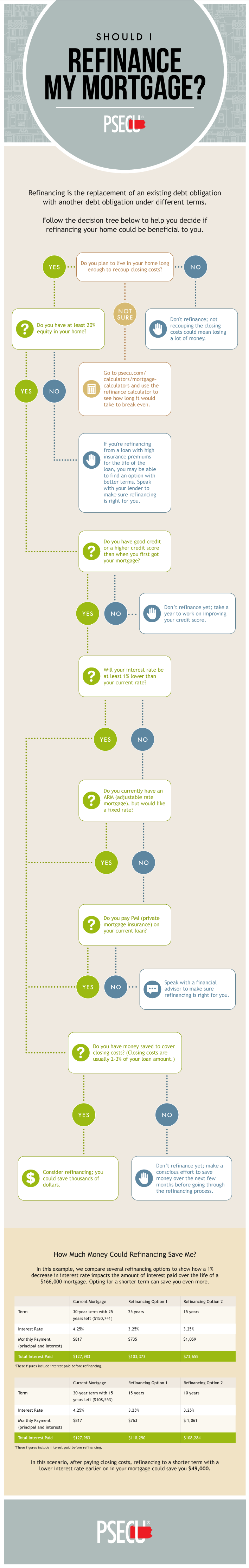

And for those considering refinancing your mortgage, learn more about the process with this helpful infographic created by Pennsylvania credit union, PSECU.