When you suddenly find yourself in need of a small amount of money, and don’t have any other options, where can you turn for help? One option is to try to get a small amount of money online. This can be done in a number of ways, and each method has its own set of pros and cons.

Table of Contents

Tips for Getting a Small Amount of Money Online

One way to get a small amount of money online is to sell something you own. This could be something you’ve been wanting to get rid of for a while, or it could be something you need to sell quickly. The advantage of this method is that you can usually get your money relatively quickly. The disadvantage is that you may not be able to sell the item for as much as you would like.

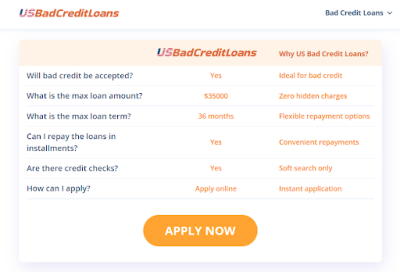

Another way to get a small amount of money online is to take out a loan from an online loan broker like US Bad Credit Loans. US Bad Credit Loans is a great option if you need loans for bad credit. The advantage of this method is that you can usually get your money quickly even your credit is bad.

A third way to get a small amount of money online is to borrow money from a friend or family member. This can be a great option if you know you will be able to pay the money back quickly. The advantage of this method is that you don’t have to pay any interest. The disadvantage is that you may end up damaging your relationship with the friend or family member you borrowed from.

Finally, another way to get a small amount of money online is to try to get a loan from a bank or credit union. This can be a good option if you have a good credit score. The advantage of this method is that you can usually get a loan for a larger amount of money. The disadvantage is that you may have to pay a high interest rate.

No matter which method you choose, be sure to read the terms and conditions carefully before you apply. Also, be sure to only borrow as much money as you need. If you borrow more than you need, you may end up paying more in interest and fees.

An Online Payday Loan Is A Good Way To Help You Out When In Emergency

When you are in a tough spot financially, an online payday loan can be a lifesaver. These loans are quick and easy to apply for, and they can help you get the money you need to cover unexpected expenses. Here are some of the benefits of taking out online payday loans:

- Quick and easy application process.

- No need to fax documents or go through a credit check.

- Funds can be deposited directly into your bank account.

- Flexible repayment terms.

- Can be used for any purpose.

If you are in need of emergency cash, an online payday loan is a good option to consider. These loans are available to people with bad credit, and they can help you get the money you need to cover unexpected expenses.

What Are Requirements Of Getting A Payday Loan Online?

If you need money quickly and are considering applying for a payday loan on US Bad Credit Loans, it’s important to understand the requirements for getting one. Here’s a look at what you need to know:

To be eligible for a payday loan, you must be employed and have a steady income. You must also be a U.S. citizen or permanent resident, and at least 18 years old.

You’ll also need to provide proof of income and residency, as well as a valid ID. In addition, you may need to provide a recent bank statement and proof of your Social Security number.

The requirements for payday loans vary from lender to lender, so be sure to read the terms and conditions carefully before applying. If you meet the requirements, you may be able to get the money you need in as little as one business day.

How To Apply For A Payday Loan Online With Bad Credit

If you have bad credit and you need money quickly, you may be wondering if you can apply for a payday loan online. The answer is yes, you can! However, it’s important to understand how payday loans work and what to expect before you apply. A payday loan is a short-term loan that is typically due on your next payday. The loan is typically for a small amount of money, and the interest rate is high. However, payday loans can be a helpful tool if you need money quickly and you have bad credit.

To apply for a payday loan online, you will need to provide some basic information, including your name, address, and Social Security number. You will also need to provide proof of employment and income. The lender will use this information to assess your creditworthiness and determine if you are eligible for a payday loan.

If you are approved for a payday loan, the lender will typically deposit the money into your bank account. You will then need to repay the loan on your next payday, along with the interest and fees.

If you are unable to repay the loan on your next payday, you may be able to extend the loan. However, you will need to pay additional fees and interest. You should also be aware that if you do not repay the loan on time, you may be subject to penalties and collection actions.

If you are considering applying for a payday loan from online broker like US Bad Credit Loans, be sure to read the terms and conditions carefully. Be sure you understand how the loan works and what the fees and interest rates are. Also, be sure you can afford to repay the loan on your next payday.

How Long Will It Take To Get The Approval Of A Payday Loan?

When you’re in a financial pinch, a payday loan can be just the break you need. However, you may be wondering how long it will take to get the approval of a payday loan.The approval process for a payday loan can vary depending on the lender. However, most lenders will require some basic information, such as your name, address, and employment information. In most cases, you will also need to provide proof of income.

Once you submit your application, the lender will review it and decide whether or not to approve your loan. If your loan is approved, the lender will deposit the money directly into your bank account.

In most cases, you can expect to receive the approval of a payday loan within minutes. However, in some cases it may take a little longer. If you have any questions about the approval process, be sure to contact the lender directly.