Buying property is in most cases a worthwhile investment. With property prices constantly going up, you’re bound to make your money back if you choose to sell. However, getting your foot on the property ladder involves having those initial funds. For those considering buying a house or a flat, here is a breakdown of the costs you need to consider when taking the decision to become a homeowner.

The deposit

Before you can consider a mortgage, you need to be able to afford the deposit. This is usually between 5% and 20% of the property’s value (for example £10,000 to £40,000 when buying a £200,000 home). Generally, the higher the deposit you’re able to leave, the more likely you are to get a mortgage. Pay a small deposit and your mortgage may also take longer to pay off, resulting in more interest.

The mortgage

The mortgage is the biggest loan of your life, so getting a good deal is important. You can use a mortgage calculator with property taxes to work out how much you’re likely to spend on a particular property with a particular mortgage. Most mortgage companies also have added arrangement fees of up to £2,000, plus a booking fee which could cost up £250. Some companies may also charge a valuation fee, which can cost anything from £150.

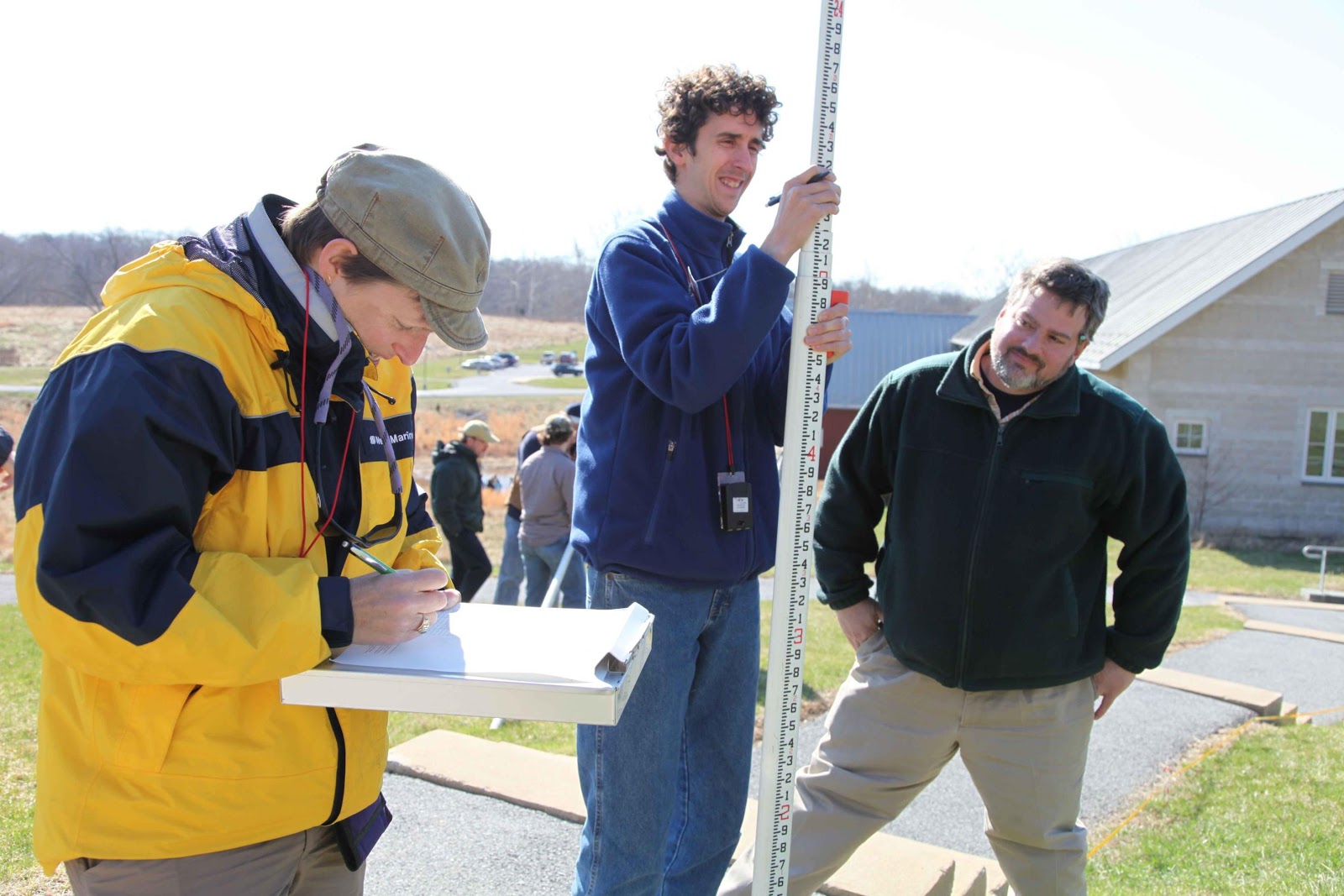

Surveyor fee

This is an optional cost, but many buyers will invest in a surveyor to check that the property hasn’t got any structural problems or damage that could result in pricey repairs later down the line. A basic home survey costs £250, but if you want a full structural survey this can cost up to £600.

Electronic transfer

A hidden cost for many, the mortgage company may charge an electronic transfer fee for handing over the mortgage to the seller. Fortunately, this is not a big cost and generally doesn’t come to more than £50.

Agency fee

Generally, only the seller has to pay an agency fee. Some estate agents however may also charge a ‘buyer fee’. This is something to look out for – ideally try to avoid an agency that charges this. Agency fees to buyers can vary in price.

Removal costs

Once you have bought your property and are ready to move in you have one final cost – that being the removals. Hiring a removal company can cost anywhere between £300 to £600 depending on how much you need moving, although you can save money and do it yourself by hiring a van. Some removals companies will provide the cost of cardboard boxes, bubble wrap and other packaging, sometimes as part of the price, sometimes as an extra. If not included you may have to buy this yourself, but this shouldn’t be too costly compared to previous costs (in fact, some retailers may even offer you old boxes for free).