In 2020, the IRS changed its system for reporting compensation for non-employees like independent contractors, freelancers, and other service providers. While you used to report those wages to the IRS using Form 1099-MISC, you now use the 1099-NEC form from the IRS.

If you haven’t filled this form out before, you might wonder how to fill out a 1099 NEC.

Read on to learn what you need to know about this form, including the correct way to fill it out.

What Is Form 1099 NEC?

Form 1099-NEC is required by the IRS to report payments and income made to non-employees.

This form is used when payments to this group are over $600.

Before the 2020 redesign, an employer would report this non-employee compensation using Form 1099-MISC.

The IRS was finding that often taxpayers in this group were reporting income. They would report low income and high deductions that didn’t match up.

The redesign and new form were the IRS’ way to address this issue so they would get paid taxes on any of this income.

Who Gets the 1099 NEC Form?

These non-employees might include:

- Independent contractors

- Freelancers

- Sole proprietors

- Self-employed individuals

You might be wondering if you have hired anyone from the above list. Remember to consider the $600 amount and the idea of services provided. If you hired someone for a service and paid them over the $600 threshold, they should get Form 1099-NEC.

You did not remove taxes or any other form of deductions from the pay. This form is the IRS’ way of holding the person accountable for paying taxes on those payments.

Filling Out 1099 NEC Form

If you’re responsible for filling out Form 1099-NEC, you must first order the appropriate forms. You can do this on the IRS website.

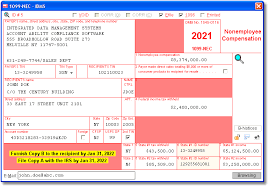

The form asks you to include information about your business, including your business name, business address, and employer identification number. This is the number the IRS has assigned to you as a business. They can then connect all records with that number to you as a business.

You will enter either the social security number or the recipient’s taxpayer ID number onto the form.

Box 1 on the form asks you to provide the total amount paid to the recipient during the previous tax year.

You may have taken backup withholdings from this pay, although that’s not usually required. If you did take withholdings, you’d enter this amount in Box 4.

There is Box 5, 6, and 7 on the form. The IRS doesn’t require you to do anything with these boxes. Some states require additional information from these boxes, depending on where you live.

The IRS expects you to complete these forms and have them filed by January 31 from the previous tax year.

What You Need to Know About Form 1099-NEC for the IRS

Now that you understand what the IRS needs and know how to fill out a 1099 NEC, you can fulfill their requirements.

You may want to make it easy by using our 1099-NEC payment generator. Check out how it works and make things simpler for yourself and those who will get the form from you.