You’d agree with me that one way to attain financial independence and earn money passively is by investing in real estate.

However, to enjoy the most out of this asset class, you must be aware of the steps involved in deriving a fortune from your real estate investment.

Here we go:

Table of Contents

1. Source for Information

Get as much information via “build a real estate empire books” and “build a rental property empire pdfs” before taking the first leap into real estate investment. Likewise, you may read articles and publications on how to start a rental property business. The knowledge you derive will inform your decisions on the asset type to purchase.

As a beginner, in the course of your findings, you’ll learn that investing in single-family homes is the ideal type of rental property to purchase.

Moreover, to sharpen your knowledge better, join an investment club to engage with experienced investors who can deter you from making some common mistakes peculiar to budding investors. You’ll also learn real estate investment strategies that’ll help inform your decision when investing for the first time.

Some of these strategies are:

- The flipping strategy: entails fixing damaged properties for top sales. Others include

- Short-term buy and hold strategy: as an investor, you’ll purchase and keep your property for a length of time, say five years, to add value to the property

- Long term buys and holds strategy: this method allows the investor to keep their property for a long time. This technique is lucrative given its rental income

- The wholesaling strategy: investors with a penchant for marketing can employ this strategy. It entails finding a suitable property, purchasing it, and selling it better than you acquire the same

- BRRRR Investing: this real estate investment acronym stands for buy, remodel, rent, refinance, and repeat. Employing the BRRRR Method will help you create a profitable rental portfolio.

2. Get Started

The earlier you start investing, the closer you are to building wealth. Following your research, take up the risk (ensure you understand the risk) and go for a type of real estate investment you’re capable of managing effectively. This way, you can enjoy the cash flow.

As you invest, pen down your mistakes to avoid making them in the future. Learning from your past errors is one of the ways you’ll be able to build a fortune from your investment.

3. Choose a Financing Method

Real estate investment requires some capital. As a young investor, getting capital may be difficult. However, you may approach a financial institution to acquire a loan or approach hard money lenders or private money lenders. It’s best to discuss with the latter, although these sources may attract high-interest rates. However, they meet investors’ financial needs on time than banks would do. It’s important to compare mortgage rates and then discuss with the latter, although these sources may attract high-interest rates. However, they meet investors’ financial needs on time than banks would.

4. Build a Strong Team

As a real estate investor aiming to build a real estate empire, you’ll need a couple of people to work with you to achieve success. You must choose the right professionals as each of them can mar or make your empire dream.

Besides, these professionals will be there to handle the bulk of responsibilities associated with properties while you’ll have the time to continue to expand your portfolio.

Some essential players you’ll need are:

- Real estate attorney who will protect your legal rights and represents you

- A financier who will offer you cash to purchase properties of interest

- A contractor who will help you with your projects

- A real estate agent who would act as your representative in any transaction

- Contractors who will be in charge of plumbing works, roofing, installations, and repairs

Also, you must always have a second option so that you can substitute anyone who’s unavailable.

5. Acquire More Investment Properties

Building a resilient real estate empire means you have to accelerate your wealth by acquiring more investment properties. Indeed, managing one property isn’t a walk in the park. Still, with experience and educating yourself on purchasing multiple properties, you’ll be fit enough to embark on this huge step.

Furthermore, to acquire more investment properties, work with a mortgage broker who can help you source for mortgage lenders who will sponsor any long term rental properties that are of interest to you. Of course, this service doesn’t come cheap. However, it will help you in realizing your investment goal.

6. Diversify

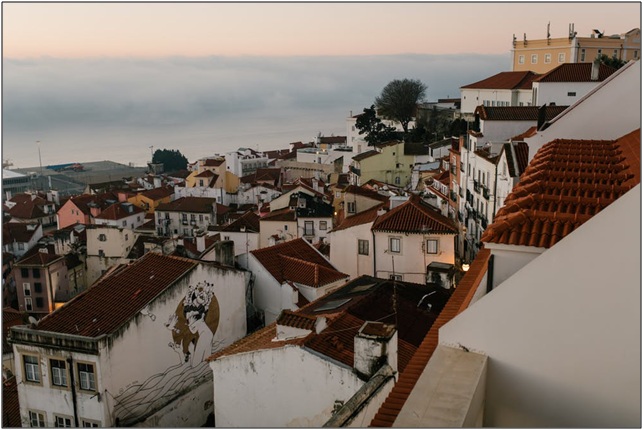

As an investor, to build a real estate empire, you must learn to diversify your portfolio. Avoid purchasing similar investment properties at all times as it’ll generate the same income.

Don’t forget; the real estate market is a broad one. Invest in different property types situated at various locations to reduce risks attached to a particular property.

What’s more:

You can learn to diversify as an investor by:

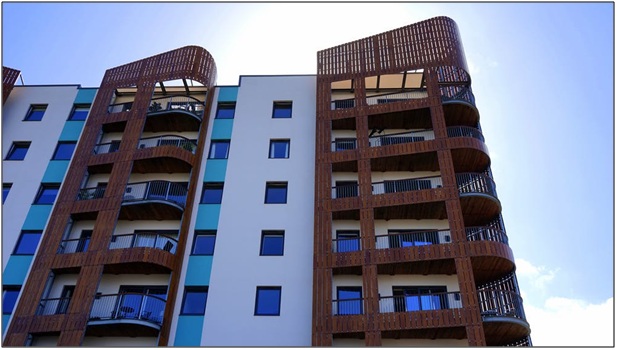

- Purchasing multi-family properties. This type of investment is easy to manage, even for a first-time investor looking to expand their investment

- Secondly, go for commercial real estate. This step will offer you high income say 6-12 percent of return of investment (ROI) compared to the 1-4 percent ROI generated from residential real estate

7. Invest in Real Estate Investment Trusts (REIT)

Two great REITs that provide consistent income/dividends every month and have for years are Fundrise and DiversyFund. They’ve both yielded 10% returns annually for nearly a decade now, but they do have some differences. Overall when you compare them both they’re both great choices though, better than most REITs.

8. Market Your Rental Properties

You need to build a strong clientele if you must have a real estate empire. First off, create a business website for your properties and incorporate search engine optimization strategies to generate leads.

Also, get a business card that you can hand out during social or business events.

9. Delay Gratification

Once the income begins to roll in from your investments, you may want to leave a luxurious lifestyle. Resist that urge. The best advice you can get at such a stage is to delay gratification.

No matter the returns you get from your investment, reinvest it by buying more properties and taking more significant risks. Through these steps, you can witness exponential growth in your portfolio.