Looking at the state of the economy right now, along with all of the current events, I have started to really worry about the state of my retirement fund. It is nerve-wracking to deposit money into an account when I am not certain that its value is going to hold up over time. Inflation is a real problem, and lately it seems to be all that we hear about in the news.

This raises the question: how much of it is fearmongering, and how much of it is true? Should we really be so concerned about our futures? We can read articles like this one, https://www.weforum.org/agenda/2022/12/top-economy-stories-december-8/, to get some sort of an idea. However, when it comes down to it, we should always be taking retirement into account when dealing with our finances.

Hopefully, the reason why that is the case is obvious to you. However, if it is not, or if you just want to know more about some of the options that you can explore, this might just be the right article for you!

Why Retirement is Something to Think About

To start this article today, I want to discuss the reasons why we should start to consider our plans for retirement as soon as we possibly can. Let us utilize a simple, purely hypothetical example: if you place ten dollars into a savings account when you are ten years old, by the time that you are twenty years old, you may have fifteen dollars thanks to interest rates.

Apply that to retirement plans and accounts: the more that you contribute when you are younger, the more that you will end up with once you do finally hit your senior years. While the real-life examples will have much more complex math, we can still take the concept and understand that it is a good life lesson.

How Does it Work?

As you can probably guess, once we start putting action to the thoughts about retiring, things get tricky. You can check out an official site that gives details on how to get started with certain types of plans. You see, due to all the various kinds of them, there is not exactly a one-stop shop for every solution.

Instead, it is a good idea to educate yourself on all of the ones that you can (or at the least, the ones that seem appealing in your eyes). Take 401(k)s, for example. They are one that is linked to your employer, although you can move them if you change your job or career. In contrast to the other methods of saving, you determine a certain amount of your paycheck that is held for the 401(k) each time. Then, your employer will match that.

IRAs, or individual retirement arrangements, are quite different. Rather than being held by our employer, we work with a financial institution to open an account. Many folks opt to use them first before something such as a traditional savings account because of the tax benefits that come with them.

Whether you go with a Roth, traditional, or self-directed one, there are different ways that your contributions are taxed. Thankfully, there is plenty of information about this all over the internet, so I will not dwell on it too long here.

What Does Gold Have to do with it?

Perhaps you are left wondering why “gold” is in the title of this article without being the main focus. Well, do not worry – that is what we are diving into right now! People have sought out alternative forms of investment or ways to store their wealth for centuries, if not for longer. This has led to the advent of many different styles of assets that we can put into our portfolios to diversify it.

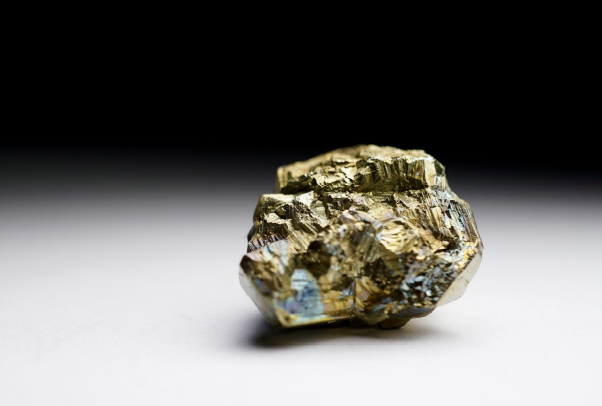

One of the primary things that falls into this category are precious metals. Not sure what those are? Check out this page if you want to know a bit more about the chemical qualifications of them. Anyone just looking to invest may not care about that, though, so let me provide a few key things to remember without getting overly technical.

Precious metals each have special qualities that makes them especially useful to us. Gold, silver, palladium, and platinum are the usual suspects here when it comes to investing as well as practical uses. Each of them has their own purposes in manufacturing goods, particularly electronics.

With a self-directed IRA, you can create an account that can house gold (or any precious metals that you have on hand). Bullion is usually what is accepted, although certain coins are allowed as well. As with the other types of individual retirement arrangements, you will have some tax benefits when you make contributions or deposits.

The question here for many people is whether it is worth it. Can gold really help at all right now in protecting our future? Why would we not just deposit traditional currency instead?

It all comes back to the inflation that I mentioned in the beginning of this article. Paper money loses value over time. By that, I simply mean that its buying power becomes degraded. How can we protect our retirement funds from that?

One method is to put some of it in gold bullion. Since it tends to keep the same value even after many years (and could even grow), it can serve as a hedge against inflation.