When a flat owner with a lease with less than 80 years left to run comes to extend their lease they will find that there is an additional element to the premium they have to pay their freeholder. That additional element is called ‘marriage value’. When a lease has more than 80 years unexpired, marriage value isn’t payable. However, the moment the lease runs under 80 years the freeholder becomes entitled to 50% of marriage value, and that can amount to a significant sum of money. In this post we are going to look at what marriage value is, and how it is calculated.

In essence marriage value is the additional value created by combining two things, the value of which is higher in aggregate than in separation. A well-recognised example is that of a pair of Ming vases which are worth significantly more sold together than they would be worth if sold individually. When a lease is extended part of the freeholder’s reversionary interest is combined with the leaseholder’s existing leasehold interest to create a longer lease. Just as with the pair of Ming vases, the total value of the leasehold and freehold interests before the lease extension is often lower than the total value of the leasehold and freehold after the lease extension. That difference in aggregate values is marriage value. When dealing with shorter leases the difference can be significant.

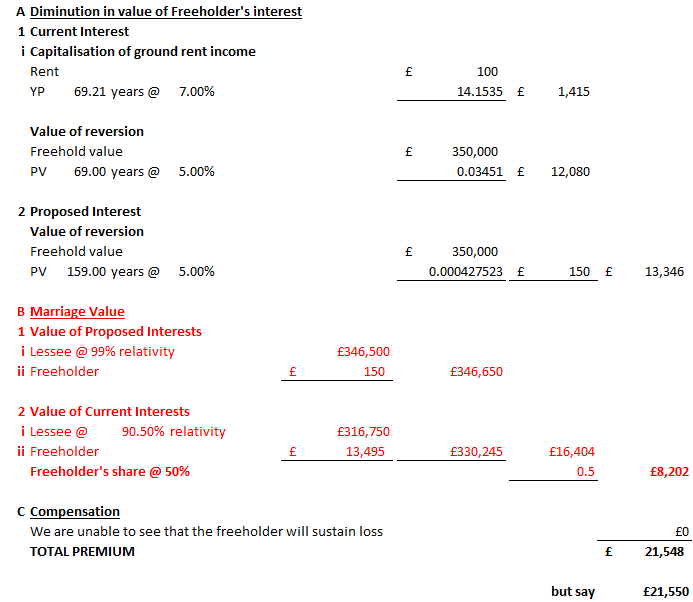

In order to calculate marriage value it is necessary to produce four valuations. Firstly, the value of the freehold before and after the lease extension must be calculated. Secondly, the value of the flat with a long lease must be calculated. Finally, the value of the flat with its current lease must be calculated.

The first three elements are fairly straightforward. The value of the flat with a long lease can be assessed with reference to comparable transactions. It is well established in case law that the value of the freeholder’s interest before and after the grant of the new lease can be calculated via the employment of an interest rate (called a deferment rate) applied to the long lease value of the flat, and another interest rate (called a capitalisation rate) applied to the ground rent.

However, in addressing this final point a complication arises from the fact that the legislation requires the current lease to be valued on the special assumption that there are no statutory rights to extend that lease. This can be difficult as, given that in practice nearly all leaseholders do have the right to extend, and many leases have already been extended, this part of the valuation often can’t be supported with comparable evidence. In most cases valuers will refer to a series of graphs called ‘relativity graphs’ which estimate the value of a lease at various unexpired terms as a percentage of the value of a freehold interest in the same property. There are a number of such graphs in existence, but the values that they suggest vary significantly. Consequently this can be a very contentious point when it comes to agreeing how much should be paid to extend a lease.

Notwithstanding this, once the valuation inputs are agreed, the actual calculation of marriage value is relatively straightforward, as shown in the worked example below.

So, in simple terms, the marriage value equation can be summarised as; 1) Value of leasehold and freehold interests after lease extension LESS 2) Value of leasehold and freehold interests before lease extension EQUALS 3) Marriage value.

Now you know what marriage value is, and how it is calculated. However, it’s unlikely that this makes you feel any better about paying it! The solution, ideally, is to ensure that you commence the process of extending your lease before the 80 year mark, so that you can avoid paying marriage value entirely. If it is already too late for that make sure that you use a valuer that specialises in this area of practice. A specialist valuer can provide you with advice and support throughout the process, and can also be called upon to negotiate on your behalf, in order to make sure you get the best deal possible.